My Growth Methods Have Been Forged

From 18 years of Frontline Sales and Marketing Experience

Working With Both Startups and Established Companies

Dear B2B Founder,

Does this feel like your current reality?

You’ve built something valuable.

But your revenue?

Volatile.

Your sales team?

Stretched, burned, or non-existent.

Your efforts feel like throwing darts blindfolded

one month’s win...swallowed by next month’s drought.

You’ve hired the agency.

Burned the budget.

Tried outbound campaigns.

Maybe even brought in a “VP of Sales” too soon.

Still--every lead feels like a miracle.

Every close feels like a war.

Your product is good. Your people care.

But the sales process is stitched together like a patchwork quilt - frayed, fragile, failing.

And if you’re honest? You’re exhausted.

The dream of predictable, scalable revenue feels… further away than when you started.

You didn’t start this business

to become a sales manager, digital marketer, an ad copywriter, or a CRM wizard

You started it to solve a problem.

To create freedom. To serve.

But now you’re stuck being everything.

And that’s exactly why I created B2B Growth Systems

My name is James Carby-Robinson.

I’m one of those rare ones who forge order from chaos.

I’ve walked the fire path of sales, rejection, and reinvention so others could rise from the ashes faster.

At 16, I stepped into the world of sales with nothing but raw hunger and a willingness to outwork everyone around me.

Cold calling 100+ strangers a day, learning how to spark a yes from silence, and mastering the rhythm of rejection.

By 20, I was running a healthcare recruitment agency built from my phone and my emails.

By 23, I was closing multimillion-dollar contracts and orchestrating deals across Europe.

I’ve built partner ecosystems with Logitech, Microsoft, and Dell.

Created winning sales scripts that turned ghost town inboxes into appointment calendars filled with real buyers.

I’ve sold SaaS. Tech. Services. Products.

And I’ve been the one called in when everything else failed.

And through it all—I saw the same pain pattern repeat:

Founders trapped in the grind, bleeding energy into sales they didn’t want to be doing.

Agencies over-promising and under-delivering, burning trust and budget.

Teams misaligned.

Funnels half-built. Growth stalled.

I knew there had to be a better way.

So I built it.

The Flamefunnels Secret Formula.

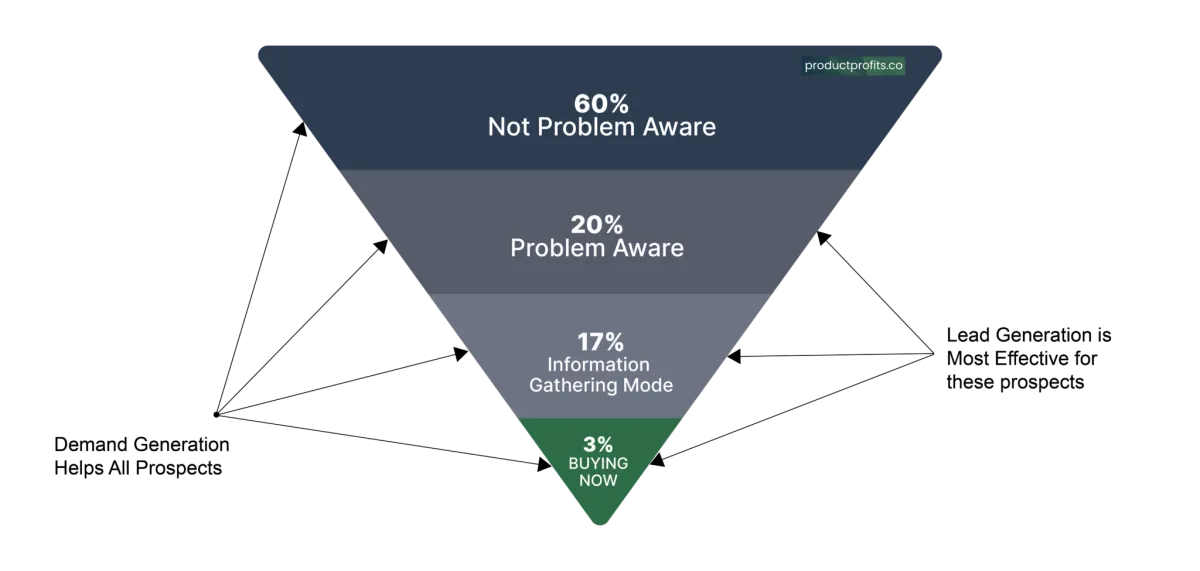

Strategy. Lead Generation. Sales. Demand Generation.

This is more than a system.

It’s a full-spectrum growth engine forged in flame.

We build it for you, install it into your business, and make sure it scales with you.

What You Get:

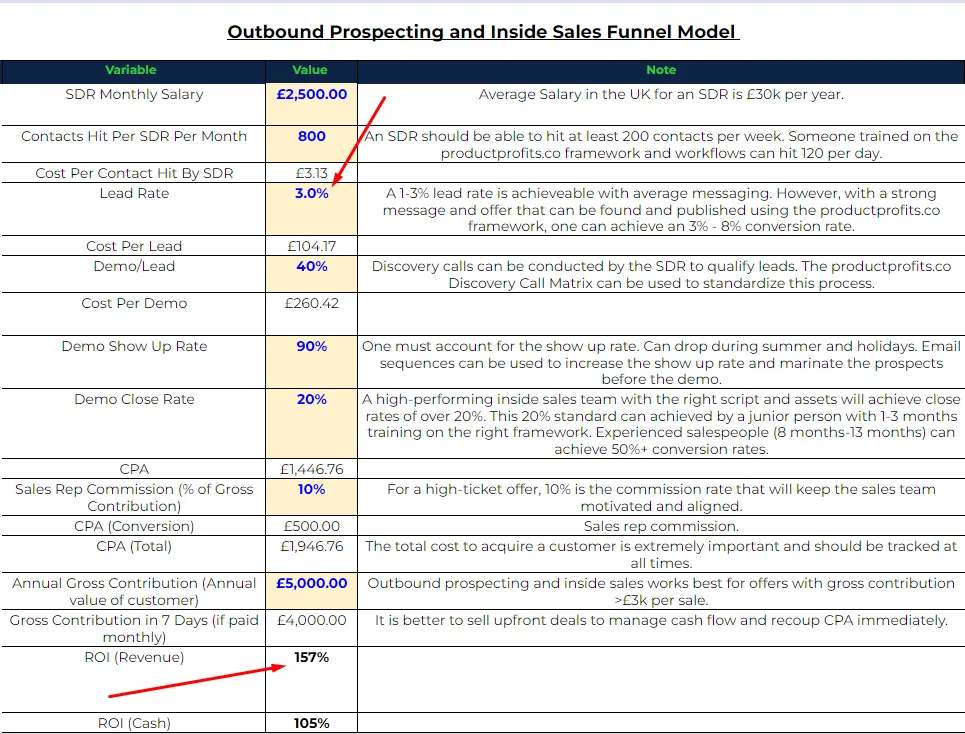

Predictable Stream of Qualified Leads without spamming or guesswork.

Funnels That Convert Cold Traffic Into Buyers 24/7. Add $10k - $500k per month onto your top line

Sales Processes That Close Deals Faster, with or without salespeople.

Growth You Can Forecast, Trust, and Scale.

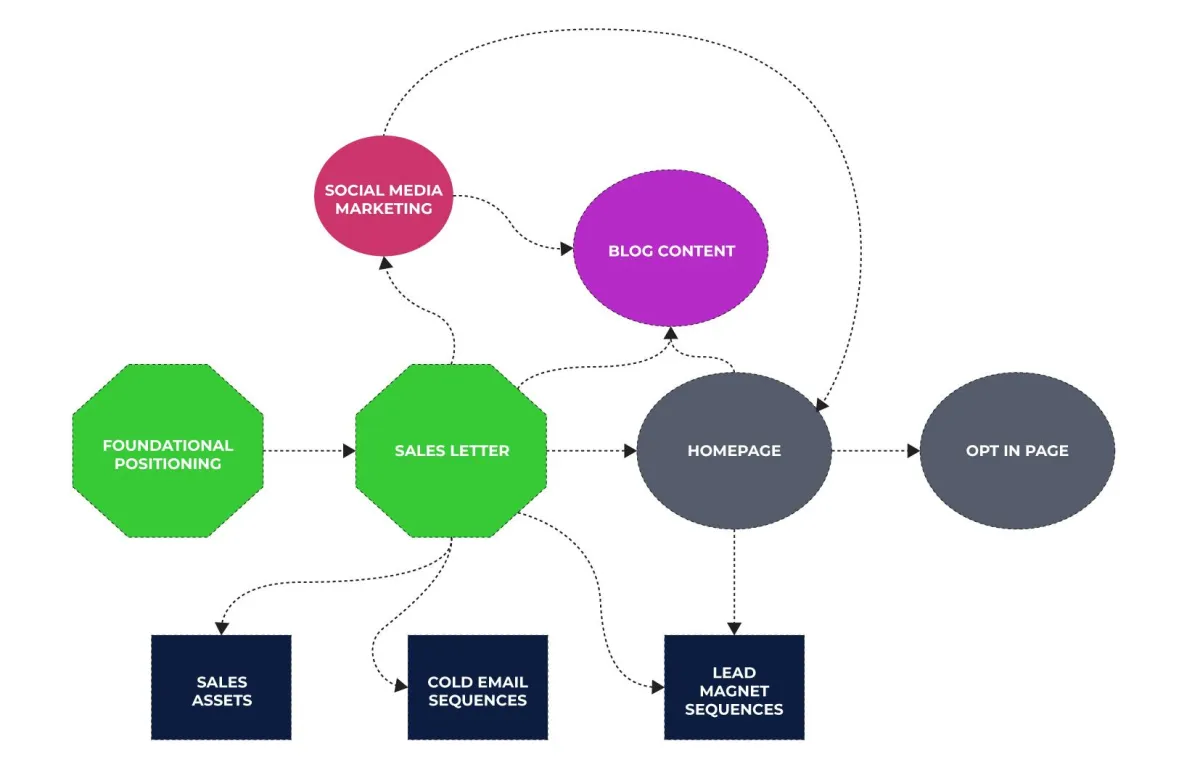

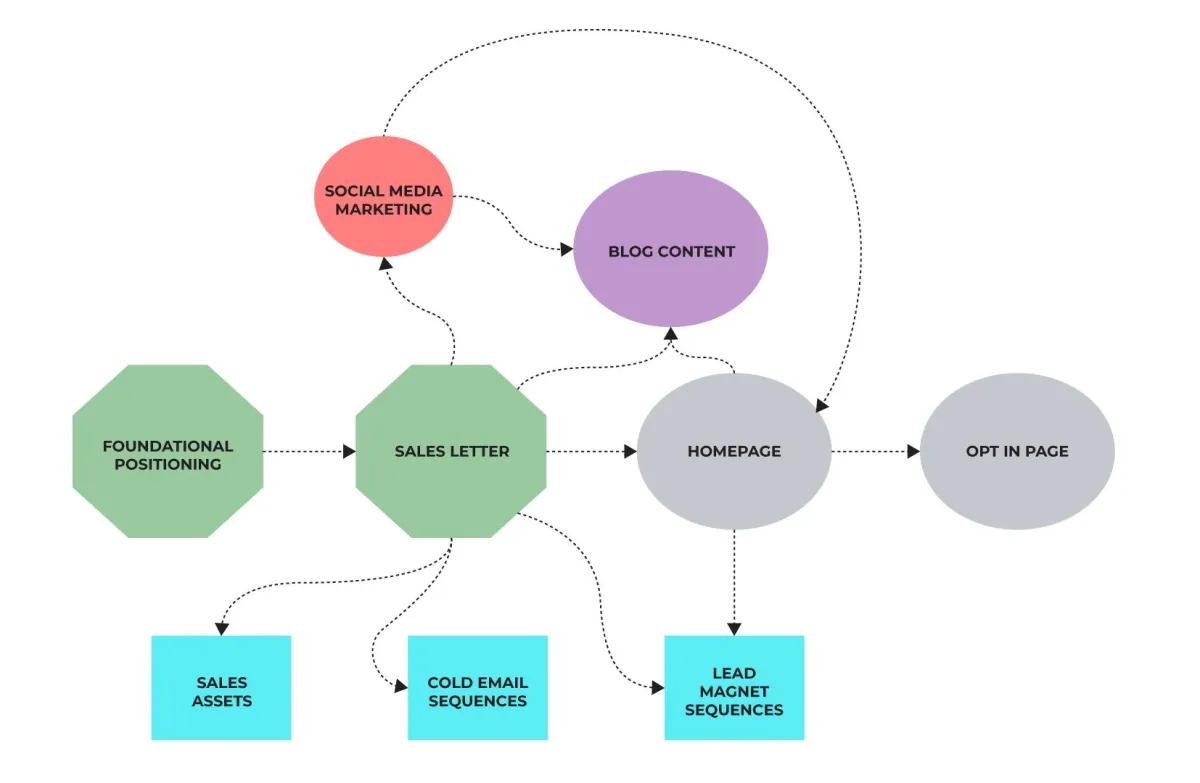

We integrate the entire system:

SEO + Content Engine

Cold Email + LinkedIn Outreach

Paid Ads (Google + Meta)

Email Flows + Nurture Systems

Funnel Strategy + Copy

Social Media + Thought Leadership

All done-for-you. All under one fire-forged roof.

But Here’s the Warning…

If you don’t fix this now:

You’ll stay trapped in the boom-and-bust cycle.

You’ll keep wasting time and budget on tactics that fizzle.

Your competitors will outgrow you.

Outspend you. Out-system you.

Your dream will wither under the weight of uncertainty.

But if you do act…

You’ll become unshakable.

You’ll know where your next client is coming from.

You’ll wake up to new leads. New bookings. New wins.

You’ll finally feel the freedom you started this for.

That’s what we build.

We call it FlameFunnels.

And it’s just one part of the B2B Growth Systems arsenal.

Ready to Install Your Revenue Engine?

Let’s build the machine that sets you free.

Let’s build the machine that sets you free.

So how did we get here?

It all started 15 years ago today...

Fresh out of school at 16, and already hopping from one job to another.

It was when Krishna Kothwal saw something in me that made things improve.

Krishna was a doctor at the Northampton General Hospital who invested in a franchise, www.Kareplus.co.uk

At 18, Krishna handed me an office, a desk, a phone, a chair, and a single goal: make money.

*At 18, I built a healthcare recruitment agency that has been running for 13 years. All I know is hard work.

His investment into KarePlus was my first sales job, and I vividly remember the franchise sales trainers' words to Krishna on my first day;

"The only this business won't grow is if he doesn't make sales calls.

And just like that, with no formal sales training, I was thrown into the deep end.

By age 20, I'd already acquired half the care home market in Northampton, filling spots with nurses in prestigious places like Burlington Court.

But truth be told, I was a young kid with too much money and not enough sense, juggling 30-40 requests for short-term staff at ungodly hours.

Ask yourself this: How many 20-year-olds want to be woken up at 3 a.m. or 4 a.m. on Friday, Saturday, and Sunday night every weekend to cover emergency shifts?

I quit two years into my role due to frequent weekend interruptions. Looking for purpose and opportunities... I fell into technology sales,

I joined the ranks of the UK's most prominent tech resellers, where I was the new kid on the block out of 200 salespeople.

I quickly learned that to be successful, I needed to be sharp, knowledgeable, and respected.

I needed to build relationships with Micosoft, Dell, Adobe, Citrix, Lenovo, Logitech, and 64 other technology brands.

Making 100 phone calls per day and sending 200 emails.

I needed to be the absolute best version of myself.

The business was simple.

Buy low, and sell high.

Find technical people and turn their skills into services you can sell.

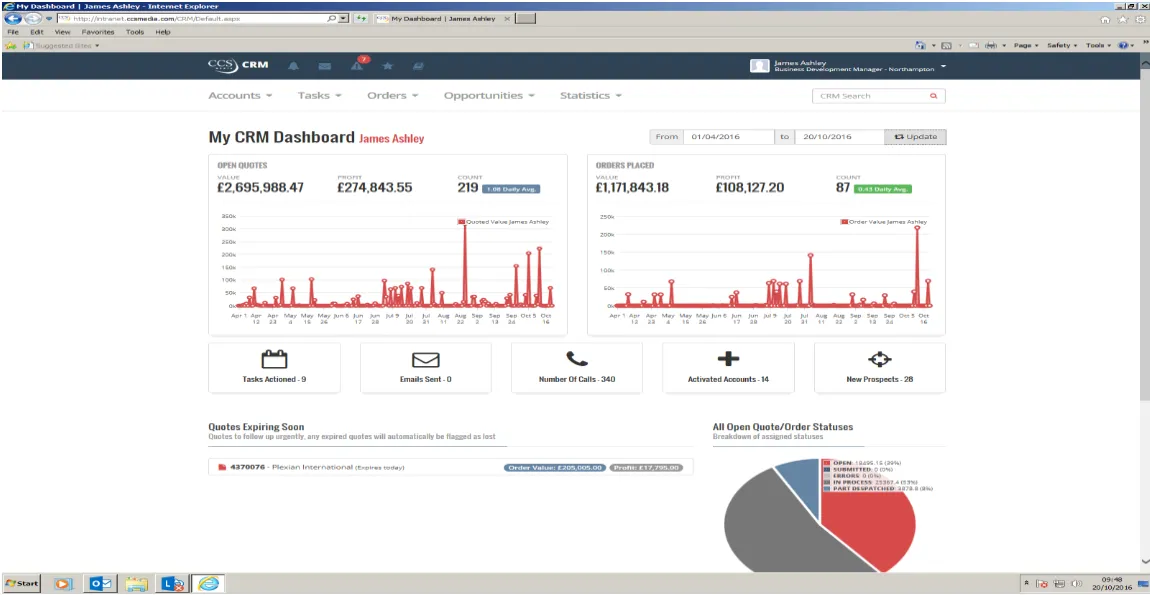

So, for six years in a row, I trained in the gym, meditated, and went to work as I honed my skills in generating $2M to $5M revenue per year.

I resold service contracts, products, and software to many public and private sector companies—everything from SME to Enterprise.

I learned how to go from $0 to $5m in 12 months using only my phone and my emails.

Within two years, I quickly surpassed all the industry veterans as one of the top salespeople in the UK technology industry.

Winning salesperson of the year and being whisked away on paid trips abroad were perks that fueled my drive.

*Only surviving screenshot. £108k profit in 4 months with £275k in the pipeline

However, in 2016, seeking more than just accolades and air miles, I opted for a 'sabbatical' across the Americas, Europe & Asia, offering my expertise to smaller tech companies.

In 2018, while based in the Philippines, I was hired by esteemed Chicago-based Revenue Generation Firm Kaul Sales Partners as VP of sales and marketing (Now OppGen.io)

We worked with over 10+ consulting and software brands with revenue between $1m and $50m.

And we sold everything from:

High-ticket consulting services to enterprise HR organizations across the USA

Enterprise-grade help-desk ticketing software for hospitals

Risk management software to SMEs through LinkedIn

We worked with a company that targeted CEOs in some of the world's largest hospitality chains, such as Disney, Starbucks, and Carnival Cruise ships.

Worked with a telemedicine provider selling B2B to insurance companies

I even launched a new product called OppGen, where I transformed the business from an Excel spreadsheet to revenue in less than 60 days. OppGen.io is still running today.

I have been in the trenches and have my fair share of war stories.

I have watched companies rise and fall.

More importantly, I have seen why b2b companies succeed in their sales and marketing and why they fail.

And my predictions were 100% correct every single time.

"It might not be now; it might be in 2 or 3 years, but if this team does not solve this gap in their sales funnel, they won't be around for long."

I could give you a graveyard of companies who did not work with me, and now they are the ones who aren't around.

And my client's businesses are still standing firm, growing like trees.

Most B2B companies are plagued by low-quality data, disorganized sales funnels, uninspiring copy, and a misalignment between sales, marketing, and leadership.

They either run around guessing their way through, or they grow their business through referrals and word of mouth and then wonder:

"Why do I feel stuck?"

Usually, the invisible barrier is your mindset or skill set.

Successful companies that have been established for 20+ years all have the correct mindset or the correct skill set. Due to limiting beliefs, companies with friction and tension tend to have bumpy rides.

This is why I learned to pick my battles wisely.

It's not about what you're selling; who you work with determines success.

If you bring to the table

A negative mindset

A poor person's mindset is "We don't have enough resources."

A selfish mindset: "What can I take? and not “What can I give?"

A short-term mindset: "Next 1-3 months, not next 1-3 years."

A reluctance to do what is necessary

Then, it just slows down our success. Most companies grow their business through referrals and content marketing.

…and this is fine if you're happy being where you were six months ago

Other companies think hiring a "lead gen firm" or a marketing agency to handle email marketing will magically increase their revenue to $10m.

When, in fact, the skills needed to grow a business holistically are:

A Solid Sales Strategy

Sales Copywriting

An Excellent B2B database

Sales Assets

Niche-specific sales funnels

A lead generation system that knows how to get conversations started

A sales support administrator to filter conversations for the SDR

An SDR who knows how to book meetings and fill the pipeline

A Seasoned Account Executive, Subject Matter Expert / Closer who can close deals and converse with executives.

A Paid marketer who can precision re-target your ICP through marketing (funnel architect)

A Solid On-boarding Experience

Service Delivery Protocol

Customer Success And After Care

If you can get these concepts correct in your business, you will be able to scale rapidly.

After my tenure as the VP of Sales and Marketing for Kaul sales partners, during which I witnessed how most companies get this wrong, I decided to start Product Profits (now, B2B Growth Systems)

Building a razor-sharp B2B growth system, tailoring it to empower smaller companies to establish efficient and impactful sales processes.

The system is highly leveraged, making life easier for everyone involved because it just works.

Every single person involved loves the process.

The sales process becomes more harmonious and better for everyone.

There are no "fires to put out."

There is no “guessing game.”

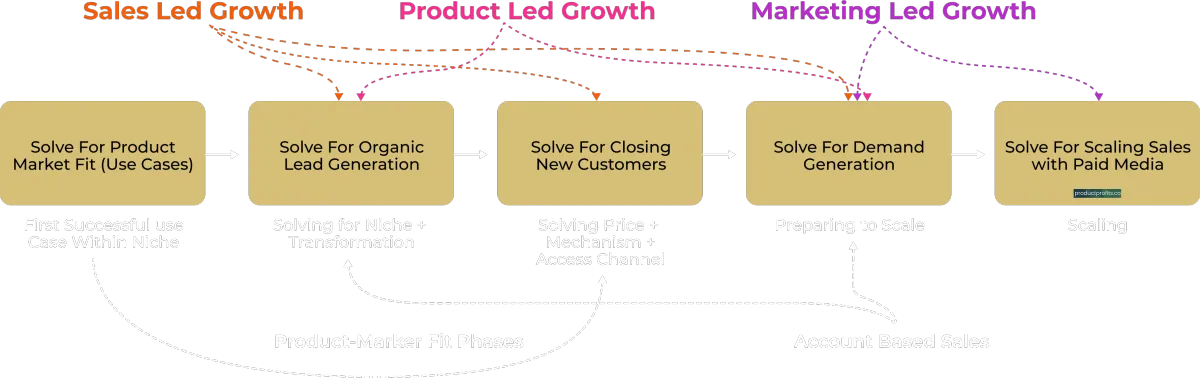

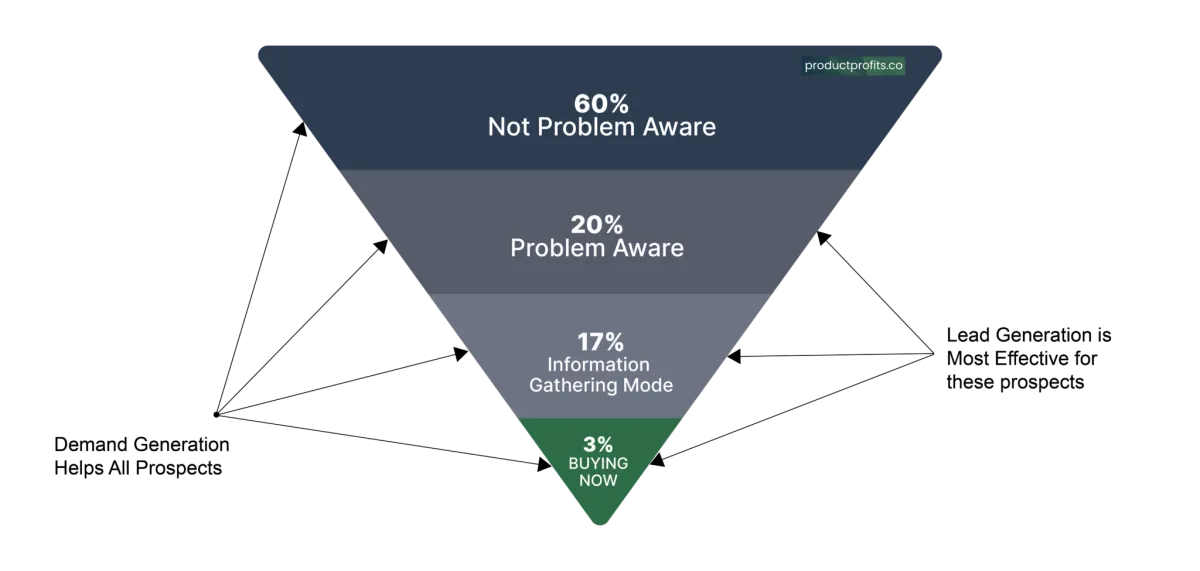

I used my experience to simplify the business growth through five critical phases:

Product Market Fit

Lead Generation

Closing Deals

Demand Generation

Scaling with Paid Media

I created a 1732-point checklist covering everything needed for a business to grow from $0 to $1m or $1m to $5m. The checklist did not focus on any one tactic but covers every aspect needed to grow

This isn't just a linear process but a cyclical growth engine that feeds into itself, improving with each iteration.

It wasn't long before the results started surpassing my wildest expectations.

One of my standout projects was with Keyura.Cloud

When Keyura Cloud approached me, they had a semi-working product but only a little else.

Within 60 days, we built the entire sales and marketing infrastructure and sales argument. Within another 90 days, we initiated 25 demos with major logistics firms and outlined a data-informed product growth roadmap based on genuine customers.

Incepteo.com was so impressed with the product launch they asked us to handle the marketing for their company!

Success breeds success, and our client base snowballed.

As one satisfied client led to the next, the reputation of my process began to precede me.

Before I knew it, the inquiries started piling up, with clients eager to replicate the success they'd heard about.

In my career I have worked with over 20+ B2B companies, including

EcoloxTech (1 year)

Software X (14 months)

Plexian International (7 years)

WonderBiz Technologies (18 months)

Kaul Sales Partners (1 Year)

many others you will see below.

My average tenure with a client is two years!

My mission is simple. I'm driven to implement this growth formula with as many companies as possible, helping them scale cost-effectively, efficiently, and without mistakes.

The truth is this: no matter where you are on Earth or how much money you have.

You CAN safely build your software, services, or technology business. With precision and efficiency without wasting a single penny on mistakes.

I have turned my experience into a roadmap—let me guide you through it.

All the best,

From Concept to Revenue

—See How I Helped SoftwareX Launch A Brand New SaaS Product Into The Market

Launching a new product can be overwhelming. But with the right B2B sales and marketing strategy, it doesn’t have to be.

We helped SoftwareX, a Seattle-based consultancy, generate 120+ organic leads and $59.5K in qualified sales pipeline within 30 days.

66% connection rate through precision targeting

30%+ response rate from optimized outreach cadences

450+ responses automatically tracked in CRM

Scalable, repeatable system for continuous growth

Want to see how we did it?

Dan Morales

Product Marketing & Development

I had the privilege of collaborating with James for a year, during which time he played a pivotal role in developing our sales and marketing strategy. James’s expertise in bridging the gap between sales and marketing was invaluable as he guided customers through the entire funnel, from unaware prospects to engaged leads.

James consistently demonstrated a keen understanding of customer needs and consistently took a proactive approach to providing customers value. His ability to analyze complex data/scenarios and translate into clear next steps and insights was impressive.

His dedication to his craft and our goals definitely set him apart. I have no hesitation in recommending James and look forward to partnering in the future.

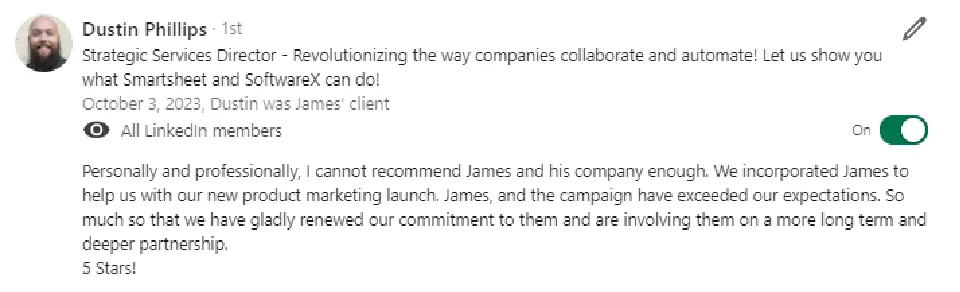

Dustin Phillips

Head of Sales

Personally and professionally, I cannot recommend James and his company enough. We incorporated James to help us with our new product marketing launch. James, and the campaign have exceeded our expectations. So much so that we have gladly renewed our commitment to them and are involving them on a more long term and deeper partnership.

From Referrals to Consistent Leads - See How I Helped This India Based Software Dev Company Generate between 2-10 High -Ticket Meetings Per Month With US-Based Engineering Managers

Struggling to generate leads in an overcrowded market?

We helped WonderBiz, a leading software development firm, build a predictable, scalable sales system in one of the most highly competitive B2B industries.

Precision-targeted outbound prospecting

Strategic sales positioning & messaging

Automated lead generation workflows

Want to see how we did it?

I helped launch OppGen from the ground up—going from conception to revenue in just 60 days.

Struggling to generate leads in an overcrowded market?

I helped build OppGen, a high-performance email marketing service, from the ground up—going from conception to revenue in just 60 days.

High-converting email sequences that get results

End-to-end sales funnel designed for scale

Proven strategies for predictable lead generation

Want to see how we did it?

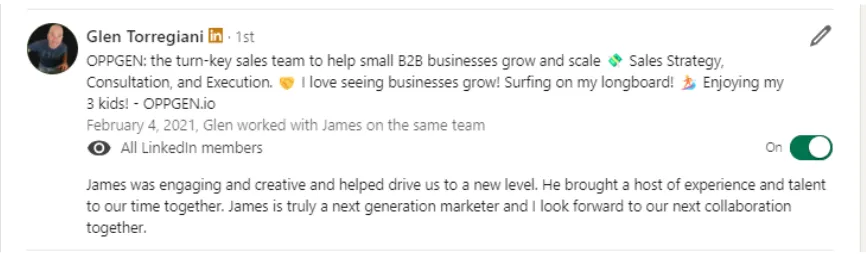

Glen Torregiani

President

James was engaging and creative and helped drive us to a new level. He brought a host of experience and talent to our time together. James is truly a next-generation marketer and I look forward to our next collaboration together.

I will help build your entire sales and marketing system

System 1

Linkedin Outreach

Email Marketing

Facebook Outreach

Outbound Calls

System 2

Content Strategy

Social Media Marketing

Community Development

Word of Mouth + Referrals

Search Engine Optimization

System 3

Pay Per Click Marketing

Paid Social Media

Content Syndication

Paid Marketing

What you get when you work with Me

I'll build, implement, and optimize your entire customer acquisition system so you can generate leads, close more deals, and scale faster—without relying on guesswork.

Here’s exactly what’s included in your done-for-you growth system:

Sales Funnels That Convert

We build high-converting sales funnels that turn visitors into paying customers.

Custom-built landing pages, opt-in pages, and sales pages

Automated follow-up sequences to nurture and close leads

Optimized to capture and convert the highest-quality prospects

Proven Result:

Launched OppGen’s new email service & secured revenue in 60 days

CRM & Sales Automations

We set up, organize, and automate your sales process so you can scale without stress.

CRM setup & pipeline management for seamless lead tracking

Automated lead scoring so you focus on the hottest prospects

No more manual data entry or lost leads—everything is fully automated

Proven Result:

Implemented a structured lead tracking & qualification process for WonderBiz

Done-for-You Lead Generation (Email & LinkedIn)

We create and run fully automated LinkedIn & email outreach campaigns to bring in high-value leads.

Automated cold email & LinkedIn prospecting to decision-makers

A/B tested messaging scripts to increase reply & booking rates

CRM integration & follow-ups so no lead is lost

Proven Result:

120+ leads generated in 30 days for SoftwareX

Sales Process Creation, Sales Scripts & Sales Training

We design and implement a complete sales process that ensures your team knows exactly how to convert leads into customers.

Cold Call Scripts – Get proven scripts that grab attention & book meetings

Discovery Call Scripts – Uncover pain points & position your offer as the solution

Closing Scripts – Handle objections & get prospects to say YES

Full Sales Training – We train your team on exactly how to use these scripts effectively

Proven Result:

Our sales scripts are battle-tested and developed in partnership with top sales trainers responsible for generating hundreds of millions in revenue across multiple industries.

Community Growth & Audience Building

We help you build an engaged community of potential customers and brand advocates.

Facebook Group Growth – Launch and scale a thriving online community

Content Strategy – Keep your audience engaged with valuable discussions & insights

Lead Nurturing – Turn community members into loyal customers

Proven Result:

Launched a Facebook group for EcoloxTech and grew it to 150+ active members in record time, creating a strong, engaged customer base.

Data-Driven Messaging & Positioning

We craft high-impact sales messaging based on real market data, not guesswork.

Competitor analysis & customer research to refine your unique positioning

A/B tested messaging for email, LinkedIn, and ads

Your brand stands out as the #1 choice in your industry

Proven Result:

Increased response-to-lead conversion to 31.9%

Nurture Sequences to Convert Prospects on Demand

Not every lead is ready to buy immediately—our automated nurture sequences keep your brand top of mind and convert prospects when they’re ready.

Drip email campaigns that build trust and move leads toward a sale

Multi-channel retargeting (email, LinkedIn, and ads) to stay in front of warm prospects

Segmentation & personalization to send the right message at the right time

Proven Result:

Increased response-to-lead conversion to 31.9%

Paid Advertising (Meta, Google, LinkedIn, TikTok & More)

We run high-performance ad campaigns that generate leads profitably.

Targeted ad campaigns on Facebook, Google, TikTok, LinkedIn & more

Retargeting & audience segmentation to maximize ROI

We track & optimize every ad so you get real sales, not just clicks

Proven Result:

Built a high-performance outbound sales system for OppGen, securing revenue within 60 days

Offer & Pricing Optimization

We help you craft a high-value offer that customers can’t say no to.

Irresistible offers designed to increase conversion rates & deal sizes

Optimize your pricing strategy to increase revenue per customer

No more underpricing or struggling to justify your value

Proven Result:

Optimized EcoloxTechs pricing offer and introduced new product packages to increase average customer value

How It Works:

The 5-Step Process to Scale Your Sales

We’ve perfected a step-by-step system to transform your sales process into a high-performance revenue machine.

Step 1: Complete Your Foundational Copy & Case Studies

We start by analyzing your market, competitors, and ideal buyers.

- Define your Unique Selling Proposition (USP)

- Build high-impact sales messaging & positioning

- Gather case studies & testimonials for credibility

Step 2: Build Your Sales Assets

We create everything you need to convert leads into customers:

- Landing pages, email sequences, sales decks

- High-converting LinkedIn & email outreach scripts

- Full sales funnel setup with automated follow-ups

Step 3: Launch High-Performance Lead Generation Campaigns

We implement a multi-channel prospecting system to generate leads:

- Automated LinkedIn outreach & email campaigns

- A/B tested messaging to maximize engagement

- CRM integration & lead tracking

Step 4: Optimize & Fine-Tune the Sales Funnel

We analyze performance & refine the system:

- Split test different messaging & outreach angles

- Optimize for higher conversion rates & response rates

- Real-time tracking of key sales metrics

Step 5: Scale & Automate Growth

Once the system is working, we scale it to predictably grow revenue:

- Expand lead generation volume while maintaining quality

- Train your team to handle & close more deals

- Optimize pricing, messaging, and follow-ups for maximum revenue

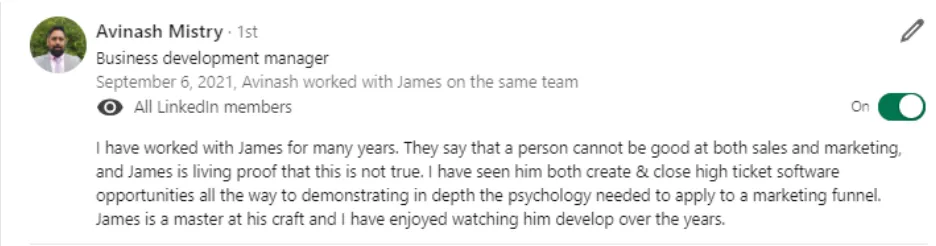

Testimonials

" I have worked with James for many years. They say that a person cannot be good at both sales and marketing, and James is living proof that this is not true. I have seen him both create & close high ticket software opportunities all the way to demonstrating in depth the psychology needed to apply to a marketing funnel. James is a master at his craft and I have enjoyed watching him devImageelop over the years. "

" I have never seen anybody build, deploy and manage a sales funnel in the way that James does. James is one of the most talented and experienced sales and marketing professionals that I have come across in my 30-year career. This month, Product Profits has generated €650,000 in sales and this should not go unnoticed.

Bravo! "

" I had the pleasure of managing James Ashley during his time at CCS Media. Over a 12 month period, James was the highest performing member of my team, and never failed to hit either a monthly or a quarterly sales target. James is tenacious, very proactive and a dynamic presence on any sales floor. I’d hire him again in a second. "

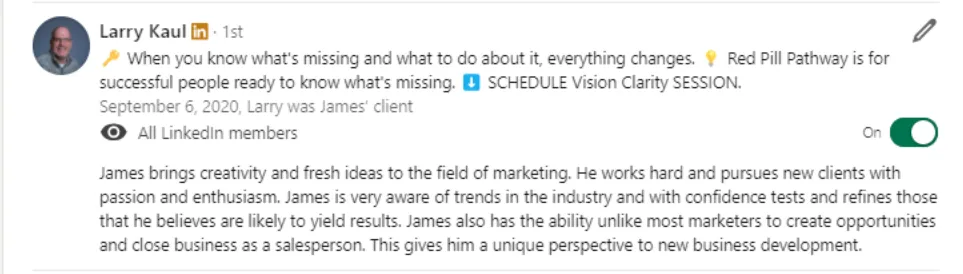

" James brings creativity and fresh ideas to the field of marketing. He works hard and pursue new clients with passion and enthusiasm. James is aware of trends in the industry and with confidence tests and refines, those that they believe are likely to yield results. James also has the ability unlike most marketers to create opportunities and close business as a salesperson. This gives him a unique perspective to new business development. "

" Personally and professionally, I cannot recommend James and his company enough. We incorporated James to help us with our new product marketing launch. James, and the campaign have exceeded our expectations. So much so that we have gladly renewed our commitment to them and are involving them on a more long term and deeper partnership. "

Frequently Asked Questions

Who is B2B Growth Systems for?

Our system is designed for B2B companies that:

✅ Sell software, services, or high-ticket products

✅ Have at least $10K/month in revenue and are ready to scale

✅ Want a proven, repeatable system for generating leads and closing deals

✅ Are tired of guesswork, bad marketing agencies, or random outreach that doesn’t convert

If you’re a B2B founder, CEO, or sales leader looking for a way to predictably grow revenue, this is for you.

Who is James Carby-Robinson, and why should I trust him?

James Carby-Robinson has over 15 years of experience in B2B sales and marketing.

✅ $15M+ in revenue generated in tech sales

✅ Worked with schools, SMEs, enterprises, hospitals, and government agencies in the UK

✅ Consulted with 50+ B2B companies across the USA, UK, Europe, APAC, NZ, and Australia

✅ Expert in go-to-market strategy, sales automation, and high-performance growth systems

James isn’t just a marketer—he’s a sales operator who has helped companies launch, scale, and dominate their markets.

How does your system work?

We use a 6-step process to build and implement your high-performance sales machine:

✅ Sales Funnels – Custom-built landing pages, email sequences & automation

✅ CRM & Automations – Full tracking & lead management system

✅ Done-for-You Lead Generation – Automated LinkedIn + email outreach campaigns

✅ Data-Driven Messaging & Positioning – Sales scripts, A/B tested messaging, & market research

✅ Paid Advertising – Targeted campaigns on Facebook, Google, TikTok & LinkedIn

✅ Offer & Pricing Optimization – Crafting a high-value, irresistible offer that converts

Our system ensures you never rely on referrals again and have a predictable, scalable revenue engine.

How long does it take to see results?

We typically launch and start generating leads within 30-60 days.

Clients have seen:

✅ 120+ leads generated in 30 days (SoftwareX)

✅ Average MRR Revenue 4x by month 2 of PPC (EcoloxTech)

✅ Revenue secured in 60 days (OppGen)

You’ll start seeing traction within the first month, and by month three, you’ll have a fully optimized sales system driving consistent growth.